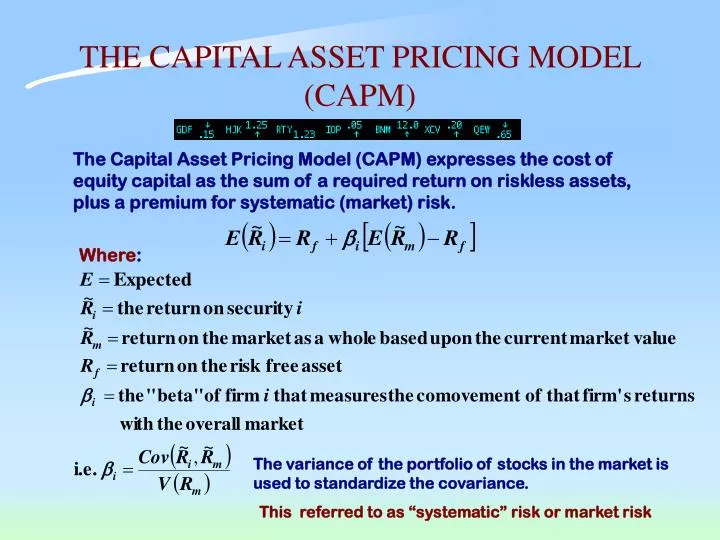

MR is the market return on an investment. (Erm – Rf) is the market risk premium, which outlines how much more an investor expects or receives because of the added riskĪnother formula for calculating the CAPM is: Β is the beta of the investment, which measures an asset's volatility in the market Here are two formulas you can use to calculate CAPM: First formula to calculate CAPMĮxpected rate of return (Er) = Rf + β (Erm – Rf) Related: Asset Management Vs Investment Banking: Differences Formulas For Calculating CAPM Second, the model assumes every investor is a rational and risk-averse person who seeks maximum returns from their investment. First, the model assumes that information about companies is available to the public and the company shares information among the public.

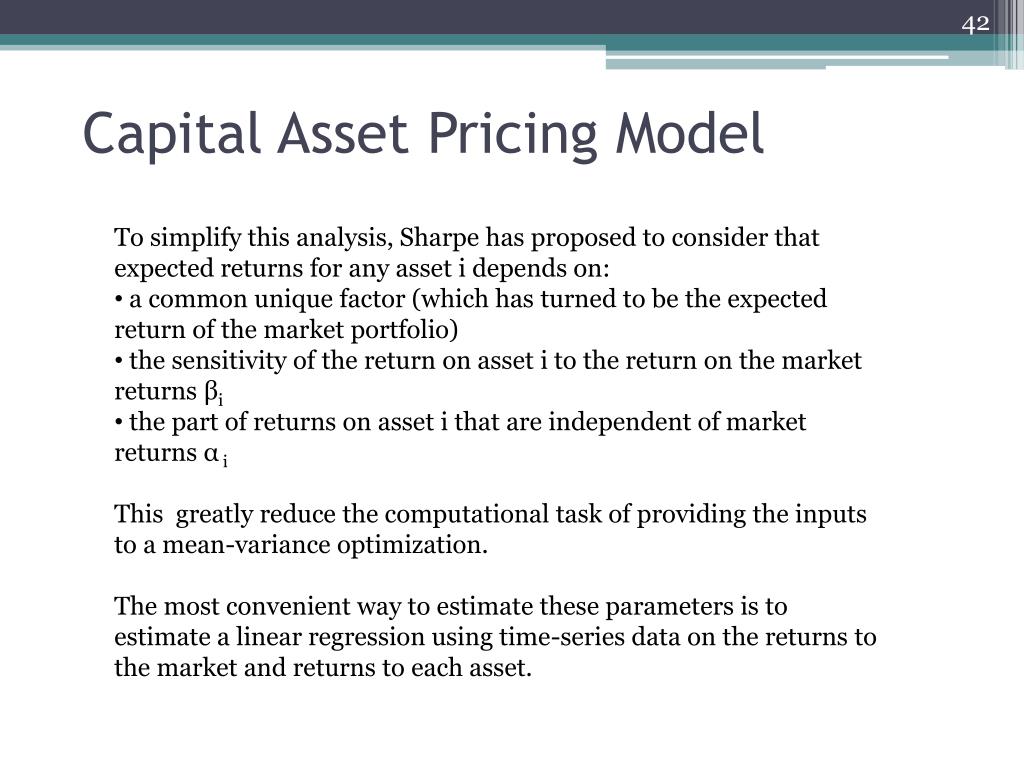

To calculate the risk associated with asset investment, the CAPM model makes several assumptions about the status of the market. Typically, the CAPM model focuses on systematic risks, such as recessions and interest rates, that apply to the entire market. This rate of return is an invaluable metric, and knowing it can help you make smart and profitable investment decisions.

The CAPM model relies on investors gaining higher yields when investing in a high-risk investment. The CAPM is a financial model showing the relationship between expected return and the risks of investing in assets, especially stocks. Knowing the answer to the question, ‘What is the capital asset pricing model?' is essential to estimate the expected rate of return for asset investment, given its systematic risk. In this article, we answer ‘What is the capital asset pricing model?', discuss its formula and components, review its importance, outline the pros and cons of using the CAPM model and explore an example.

Understanding everything about CAPM can help you make accurate predictions about your investment. Investors might use the capital asset pricing model, or CAPM, to determine an asset's risk and relative return. If you want to become a good investor, it is essential that you understand both the risks and rewards associated with an asset investment.

0 kommentar(er)

0 kommentar(er)